From 21st to 22nd of November 2022, GIZ’s Sino-German Legal Cooperation Program conducted an online workshop on how to design taxes and other levies to best promote green development. On behalf of the Federal Ministry for Economic Cooperation and Development, the workshop was jointly organized with the Budget Affairs Commission (BAC) of the Standing Committee of the National People’s Congress of the People’s Republic of China, which is usually in charge of financial and economic policy legislation of national scope. The Chinese interest goes back to the government’s plan to reform its own tax system so as to provide stronger incentives for a green transformation of consumption and production patterns. International experience and “best practices” from Germany serve as an important reference point in this regard.

On the German side, the workshop was opened by the head of GIZ’s legal program in China, Dr. Marco Haase, and on the Chinese side by the head of BAC’s legal department, Mr. Wang Wenyue. The opening remarks zoomed in on both Germany’s and China’s climate goals and thus the political goals the design of a “green” tax and levy system should contribute to. While China’s climate targets – to reach peak emissions by 2030 and carbon-neutrality by 2060 – were only announced two years ago, tax reforms to encourage green development go back much further. Mr. Su Dacheng, head of division at BAC’s legal department, highlighted the introduction of a consumption tax in 1994, an environmental protection tax in 2018, a resource tax in 2019 and, most recently, the kick-off for China’s national emissions trading system (ETS) in June 2021 as significant milestones in that regard.

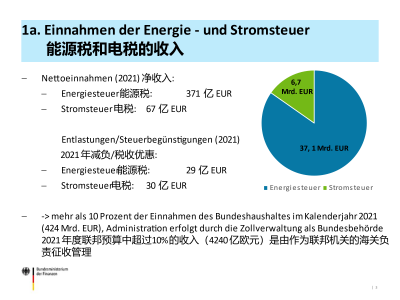

In Germany, the reforms known colloquially as “eco-tax” go back to the red-green coalition government, which first introduced the electricity tax in 1999 and then increased tax rates on various energy sources in the years thereafter. These taxes, which make up the bulk of environmentally-related government revenue in Germany today, were the focus of Dr. Hufen, Head of Department of Department III B 3 in the Federal Ministry of Finance responsible for electricity and energy tax. As his presentation made clear, the ecological tax reform was pursuing two important goals: First, the finite commodity energy was to become more expensive. Second, labour costs were to be relieved against the background of an unemployment rate which was relatedly high, even compared to the European average. After the presentation, a discussion among the participants showed, as if under a magnifying glass, the complex geo-political and geo-economic web in which energy policy is embedded today. For example, it was jointly discussed whether a reduction in the “eco-tax ” was appropriate in view of the increased energy prices Germany is facing a result of Russia’s war in Ukraine. As a result, conflicting goals between climate protection on the one hand and socio-political considerations on came into focus, also with a view to China. The European Commission’s reform proposal on the Energy Tax Directive was met with particular interest. What is more, the fact that China similarly debating issues such as how to best reflect the environmental performance of energy products in environmental taxation underlined the relevance of a cross-border exchange on the subject.

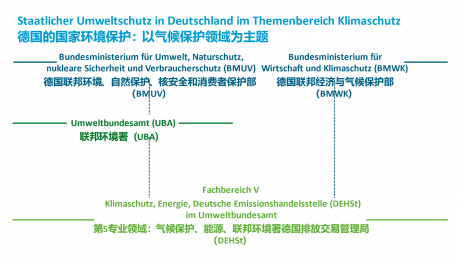

The second day focused primarily on the European (EU-ETS) and German (nEHS) emissions trading systems. Mr. Jan Weiß, deputy Head of department V 3.3 for basic economic issues of emissions trading, offered participants an insight into the nerve center of the German Emissions Trading Authority (DEHSt). His reflection on key implementation experiences and success factors of the EU ETS was met with particular interest, including: (1) secure politically agreed climate targets through a cap on emission certificates; (2) maximize emissions reduction effectiveness through effective pricing; and (3) auction emission certificates away to open up new fiscal policy room. The Chinese experts also showed interest in the planned reform of the EU ETS as part of the “fit-for-55” policy program, which foresees the introduction of a cardbon border adjustment mechanism (C-BAM). The latter is intended to reduce the risk of “carbon leakage”, i. e. the risk that European companies will outsource their production to countries with less strict climate protection requirements. Since China already has its own emissions trading system in place, the discussion that followed circled around one question in particular: How can existing taxes and duties in third countries be systematically accounted for in a scientifically objective pricing mechanism for C-BAM? What is more, differences and similarities between the Chinese and European ETS were jointly elicited.

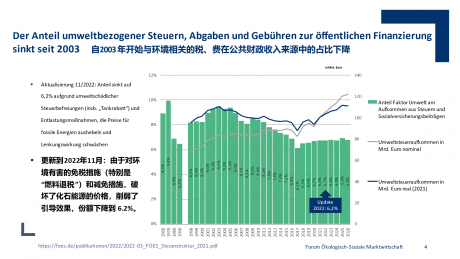

An obvious difference is that, as of today, emission certificates in China have been issued free of charge, whereas EU member states have been generating significant income by auctioning them off. What China and Germany have in common is the state makes vast expenditures to protect the environment and climate as well as such that run counter to that very goal. One example of climate-damaging subsidies in China are the significant subsidies for private heating costs, whilst in Germany the recently introduced fuel discount could be mentioned in this regard. Against this background, Mr. Bär, research associate at the Forum for Ecological and Social Market Economy (FOES), sharpened participants’ appreciation of the fact that dedicated “eco-taxes” alone cannot lead the way to a sustainable transformation of the economy and society. Rather, a holistic view of the consistency of public finances is required. As a best practice example, he presented France’s “Budget Verts”, which subjects all budgetary and tax expenditures to an analysis concerning their effects on six environmental goals of the EU taxonomy, including climate protection and biodiversity.

The roughly 20 Chinese participants mainly came from the Budget Affairs and Legislative Affairs Commissions of the Standing Committee of the NPC, from the Ministry of Finance, the National Tax Administration, the National Commission for Development and Reform, the Chinese Ministry of Ecology and Environment and from the Ministry of Justice. A participant survey showed that participants’ understanding of the German eco-tax system improved significantly. At the same time, various participants voiced their interest to deepen exchange on the topic. GIZ’s legal program will continue to support bilateral exchange on the subject.